Practical tools and strategies for advancing digital financial inclusion

© WFP/Gabrielle Menezes

Use this set of tools to enhance staff and partner capacity on digital and financial inclusion in your organization.

This section provides tools to help humanitarian/development teams improve how people access and use digital and financial services, especially those who are disadvantaged or hard to reach. The tools offer practical guidance across the project cycle – understanding needs, planning, implementation, and monitoring – and cover topics such as access barriers, payment solutions, champions, savings groups, G2P systems, and measuring progress.

This section offers humanitarian/ development teams a comprehensive set of practical tools to make cash assistance more inclusive and responsive to people’s needs, with a focus on strengthening people’s digital financial inclusion. From developing a digital and financial inclusion roadmap to addressing access barriers, understanding payment preferences, and designing cash transfers that are tailored to women, children, persons with disabilities, and minority groups. They also provide guidance for user journey analysis, how to support account opening, savings groups, digital payment systems, G2P integration, and progress measurement.

Tools and Resources

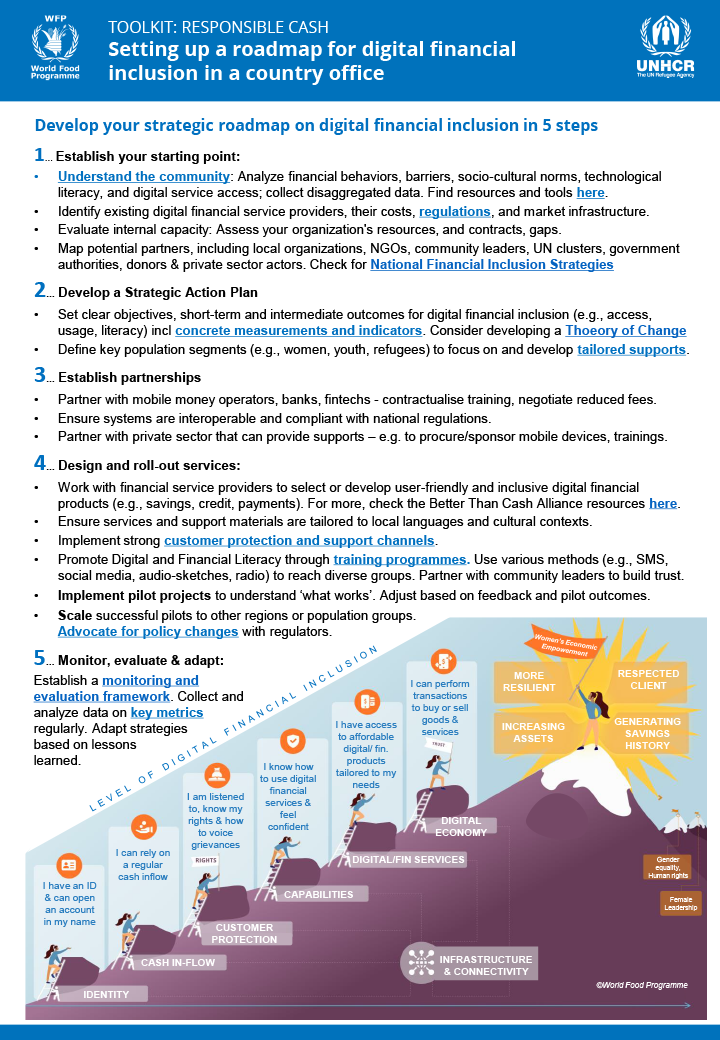

Setting up a roadmap for digital financial inclusion in a country office

Develop a digital and financial inclusion roadmap in five steps. Develop your country office’s digital and financial inclusion roadmap in five steps. This tool guides you through assessing needs around digital financial inclusion for disadvantaged and hard-to-reach populations, setting objectives as part of an action plan, building partnerships, designing and rolling out inclusive services, and […]

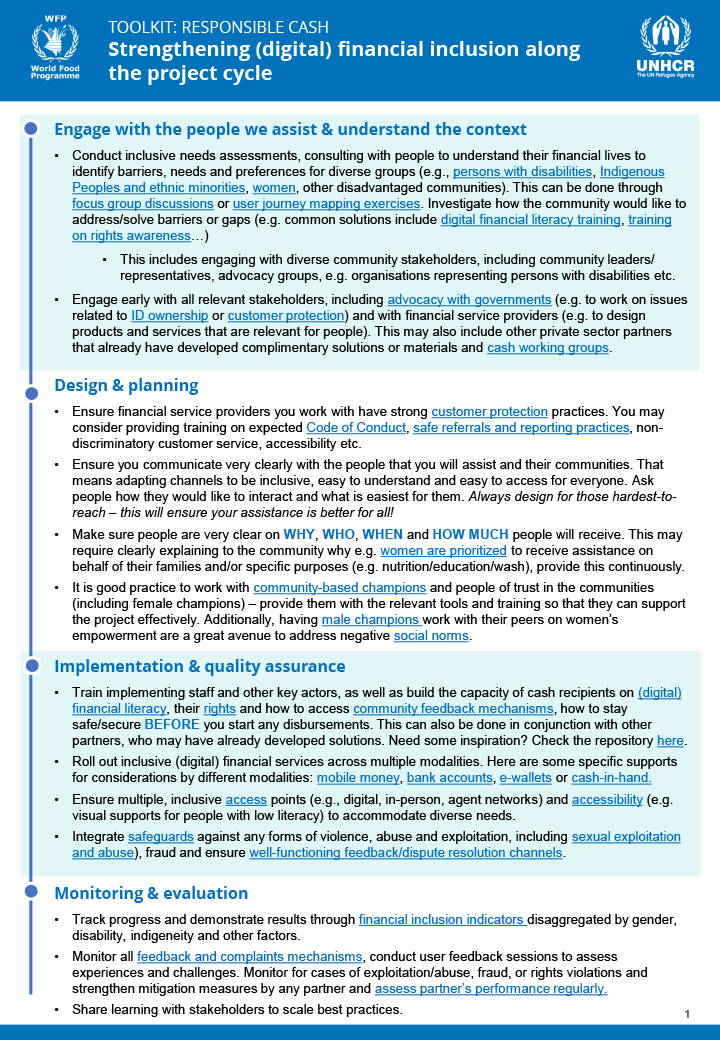

Strengthening (digital) financial inclusion along the project cycle

Guidance on how to advance digital and financial inclusion throughout each stage of the project cycle This tool helps you strengthen digital and financial inclusion along the four key stages of a project cycle: engaging with assisted people and understanding the context, design & planning, implementation & quality assurance, and monitoring & evaluation.

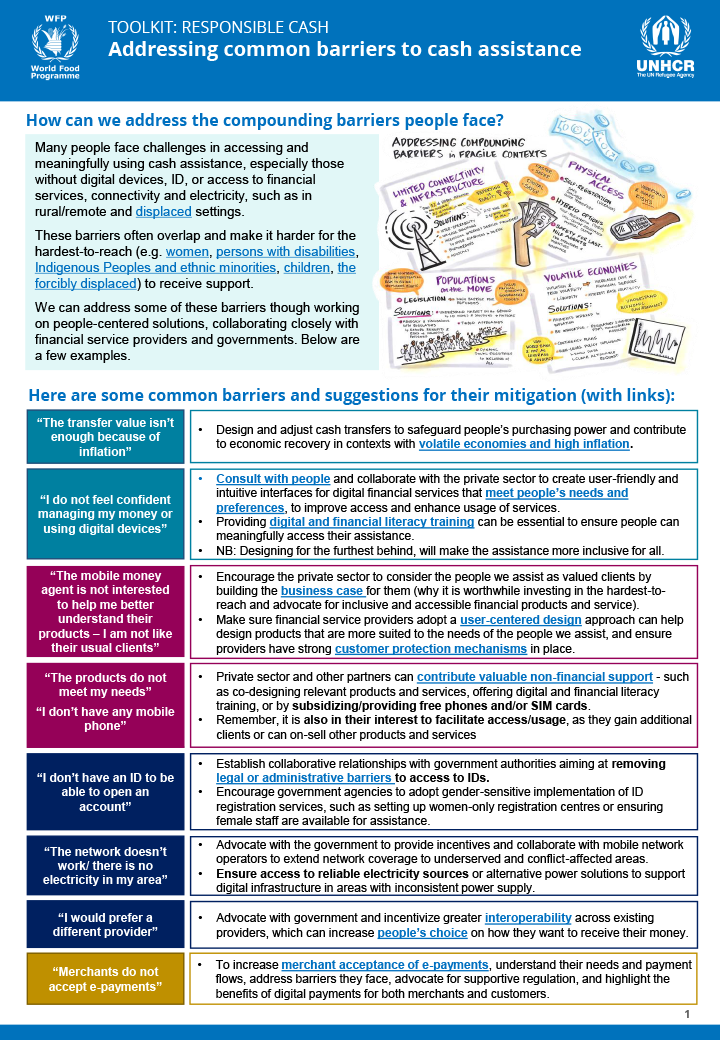

Addressing common barriers to cash assistance

Support people to overcome challenges to accessing and meaningfully using cash assistance. Many people face challenges in accessing and meaningfully using cash assistance, especially those without digital devices, ID, or access to financial services, connectivity, and electricity. This is common in rural/remote and displacement settings. This tool helps you identify and address the multiple barriers […]

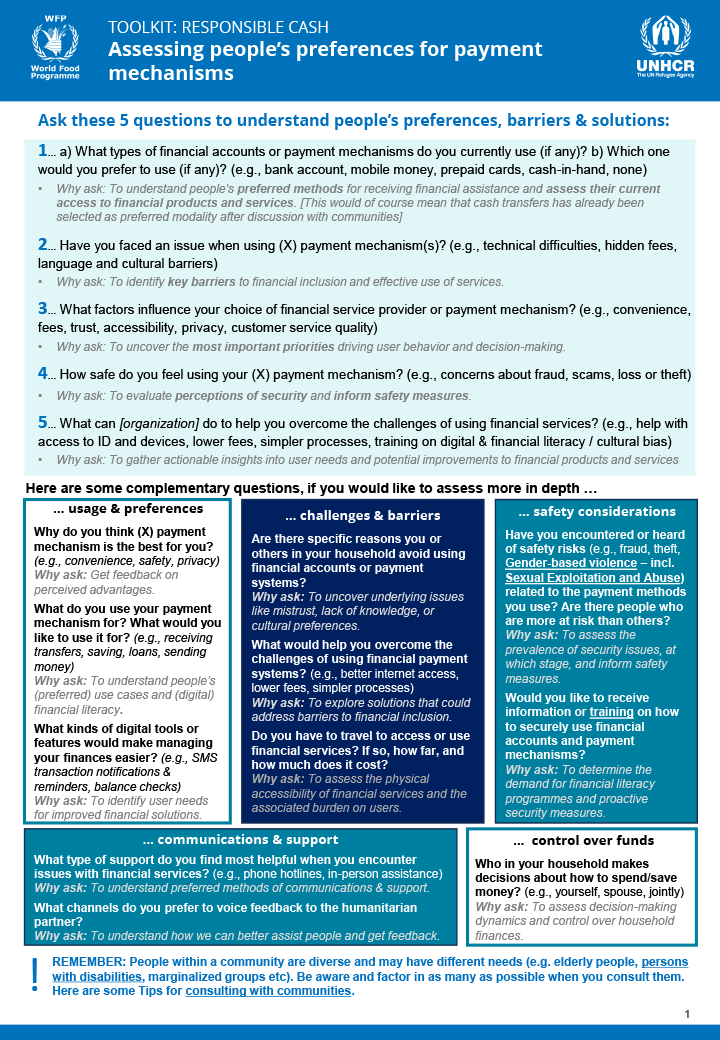

Assessing people’s preferences for payment mechanisms

Key questions you can ask to better understand people’s needs, payment preferences and barriers Use these focus group/interview questions to understand payment preferences and barriers before implementing your cash transfers /new payment mechanism. They explore current and preferred payment methods, challenges faced, safety concerns, influencing factors, and support needs. Insights help design inclusive, safe, and […]

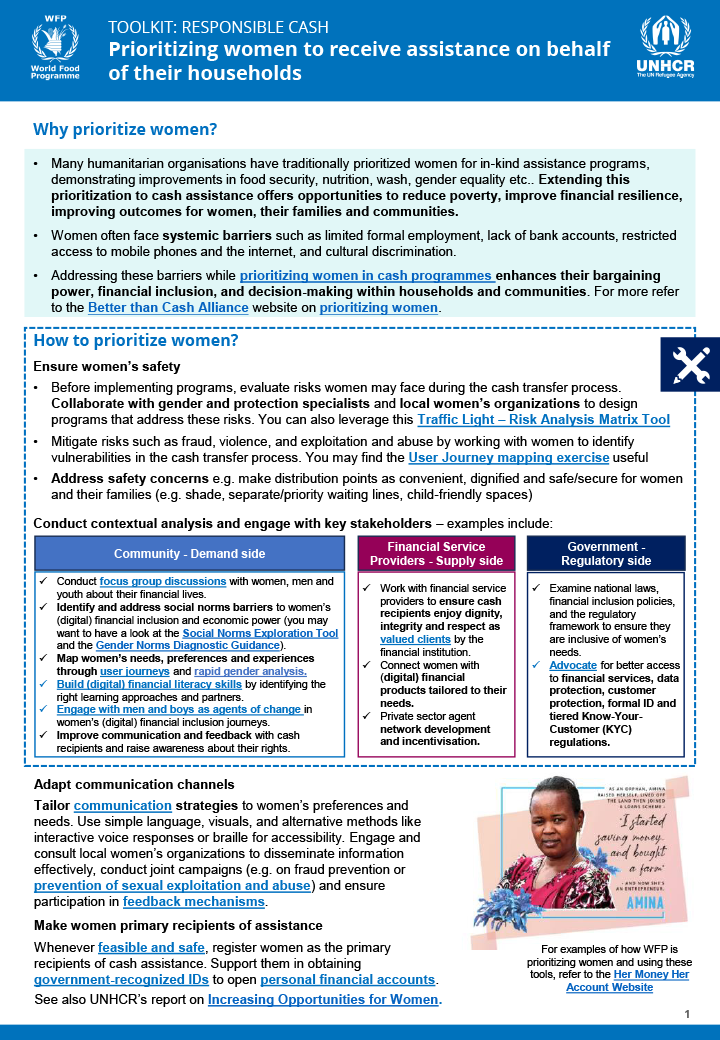

Prioritizing women

Empower women to meaningfully access and use cash assistance for improved household and community outcomes Prioritizing women in cash assistance can reduce poverty, strengthen financial resilience, and improve outcomes for families and communities. Many women face systemic barriers to access cash assistance, such as limited formal employment, lack of ID or bank accounts, restricted access […]

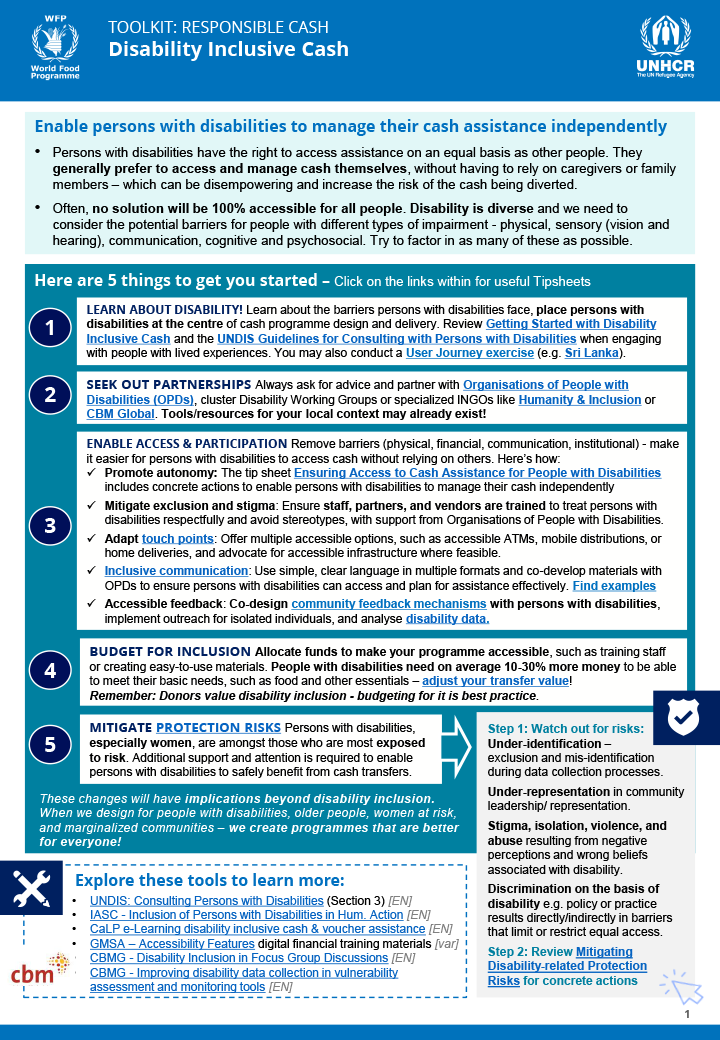

Disability Inclusive Cash

Tips to enable persons with disabilities to manage their cash assistance independently Persons with disabilities have the right to access assistance on an equal basis with others. They generally prefer to access and manage cash themselves, without having to rely on caregivers or family members – which may at times be disempowering and increase the […]

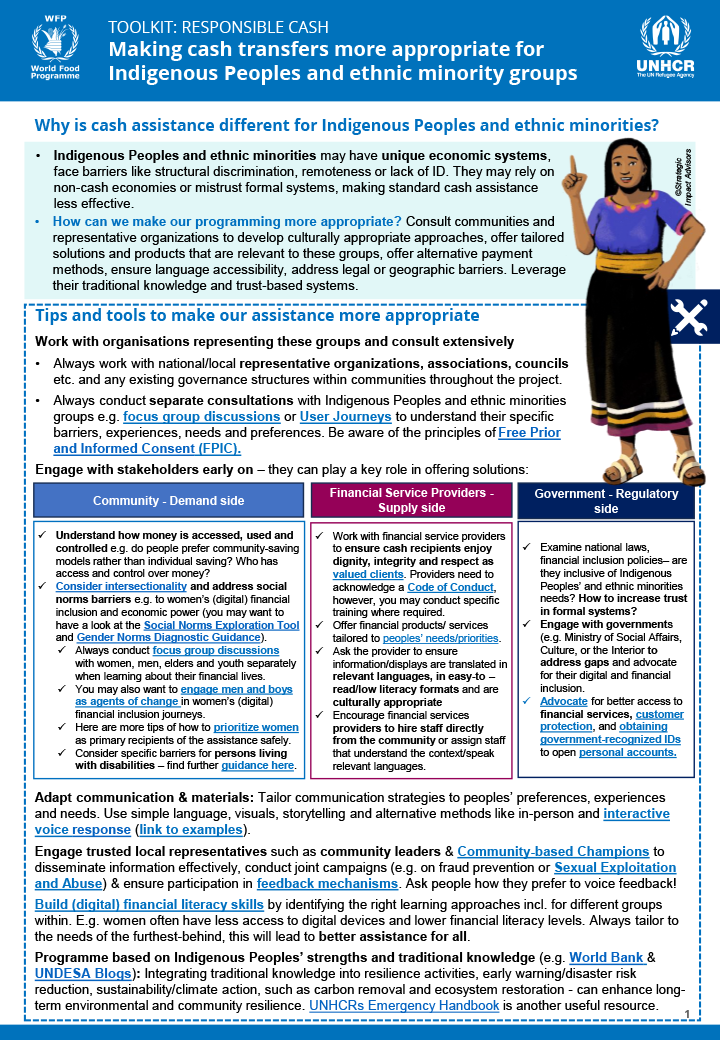

Making cash programmes work for Indigenous Peoples and ethnic minority groups

Tailoring cash assistance to meet the unique needs of Indigenous Peoples and ethnic minorities. Indigenous Peoples and ethnic minorities may have unique economic systems, and face barriers like structural discrimination, remoteness or lack of ID. They may rely on non-cash economies or mistrust formal systems, making standard cash assistance less effective. This tool is designed […]

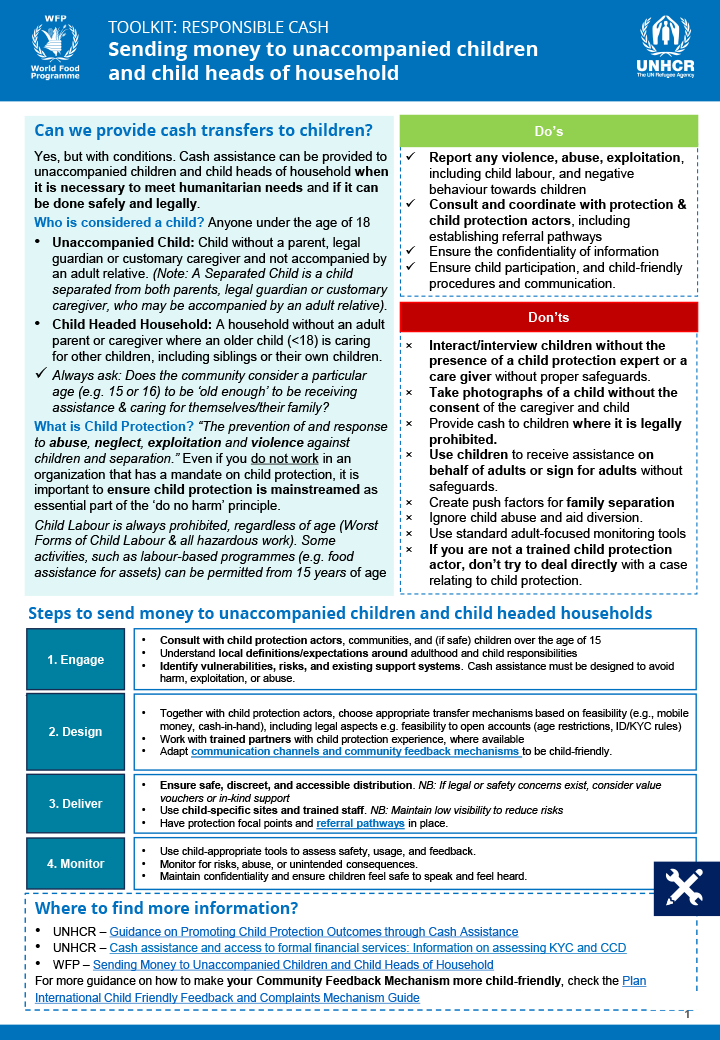

Sending money to unaccompanied children and child-headed households

How to deliver cash transfers to children – safely, legally, and in line with protection standards. Can we provide cash transfers to children? Yes, but with conditions. Cash assistance can be provided to unaccompanied children and child heads of household when it is necessary to meet humanitarian needs and if it can be done safely […]

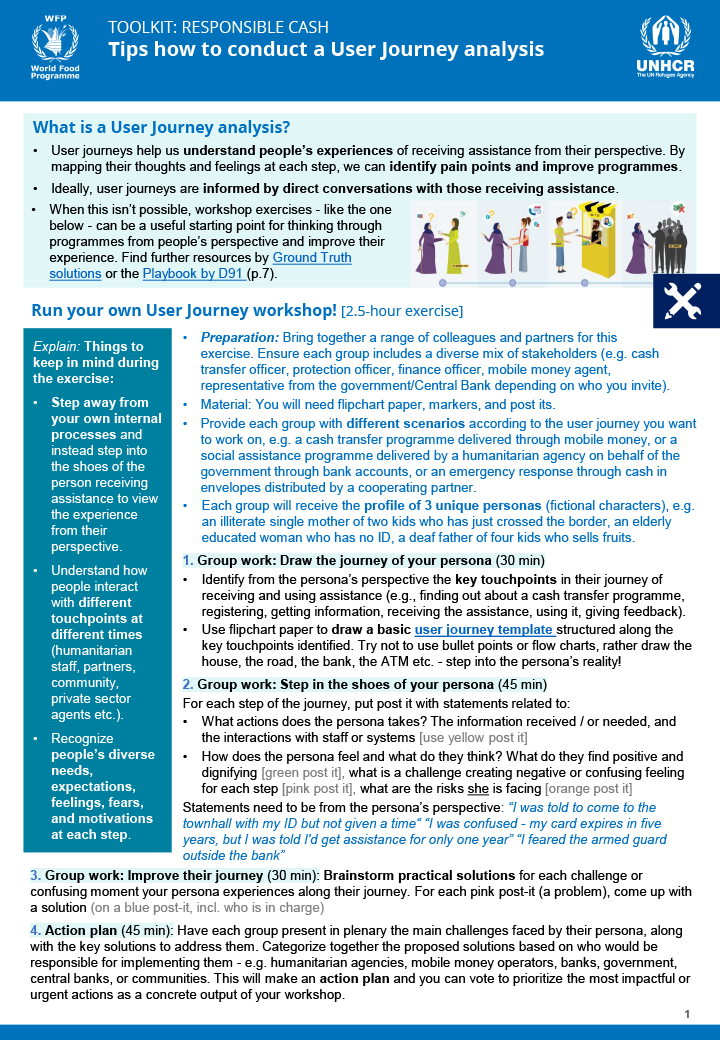

Tips on how to conduct a User Journey analysis

Understanding people’s experiences to identify pain points and improve cash assistance programmes. This tool focuses on how to conduct a User Journey analysis. User journeys help you understand people’s experiences of receiving assistance from their perspective, including people’s diverse needs, expectations, feelings, fears, and motivations at each step of the cash intervention. The tool includes […]

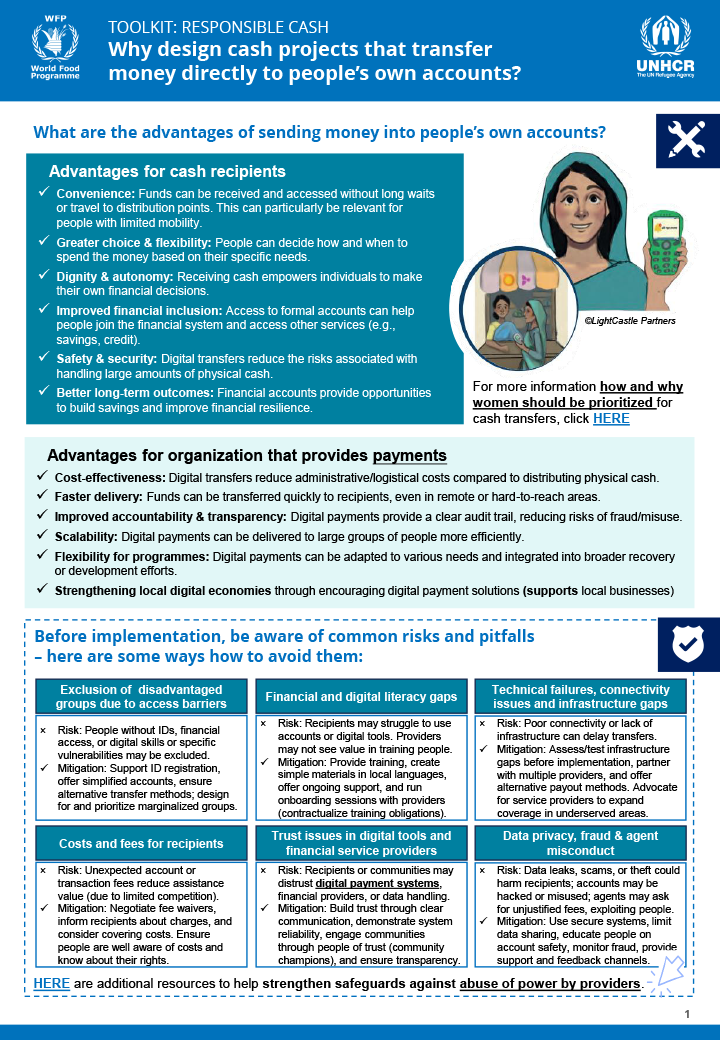

Opening accounts

Empower cash recipients by helping them open their own formal financial account for the first time. Formal financial accounts offer convenience, choice, and dignity while promoting financial inclusion, safety, and long-term resilience. This tool outlines the advantages for people having their own accounts for receiving cash transfers. It also outlines common risks and pitfalls – […]

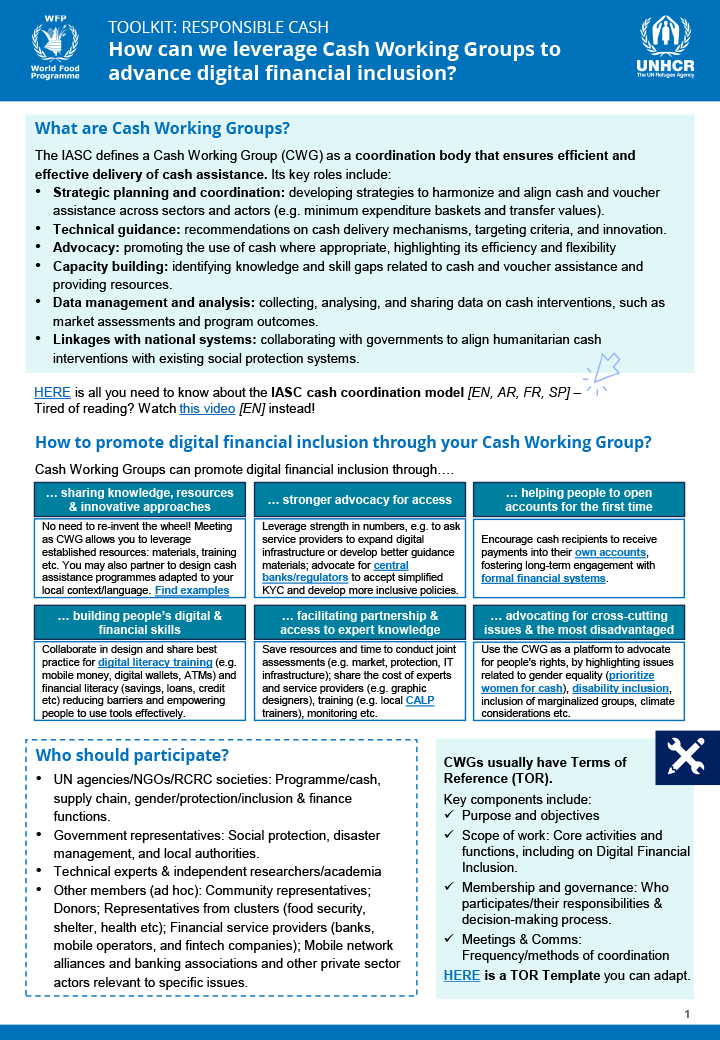

How can we leverage Cash Working Groups to advance digital financial inclusion?

Coordinate with stakeholders to drive efficient and inclusive digital financial inclusion initiatives. Cash Working Groups coordinate cash assistance interventions and can drive digital and financial inclusion by sharing resources, advocating for access, supporting account opening, and building digital and financial skills. This tool offers humanitarian/development teams guidance on how to successfully leverage Cash Working Groups […]

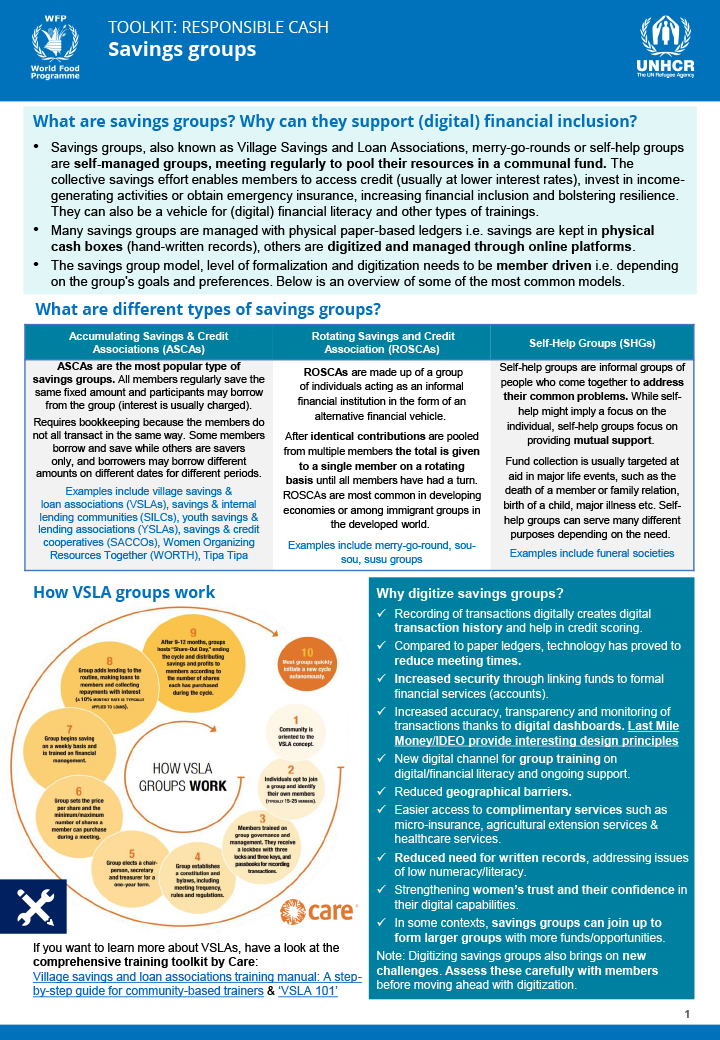

Savings groups

Harness the power of savings groups to empower communities and drive (digital) financial inclusion. Savings groups – self-managed community groups pooling resources for credit, emergencies, and income generation – boost financial inclusion and resilience. This tool provides you with guidance on savings groups and their role in supporting digital and financial inclusion. It compares different […]

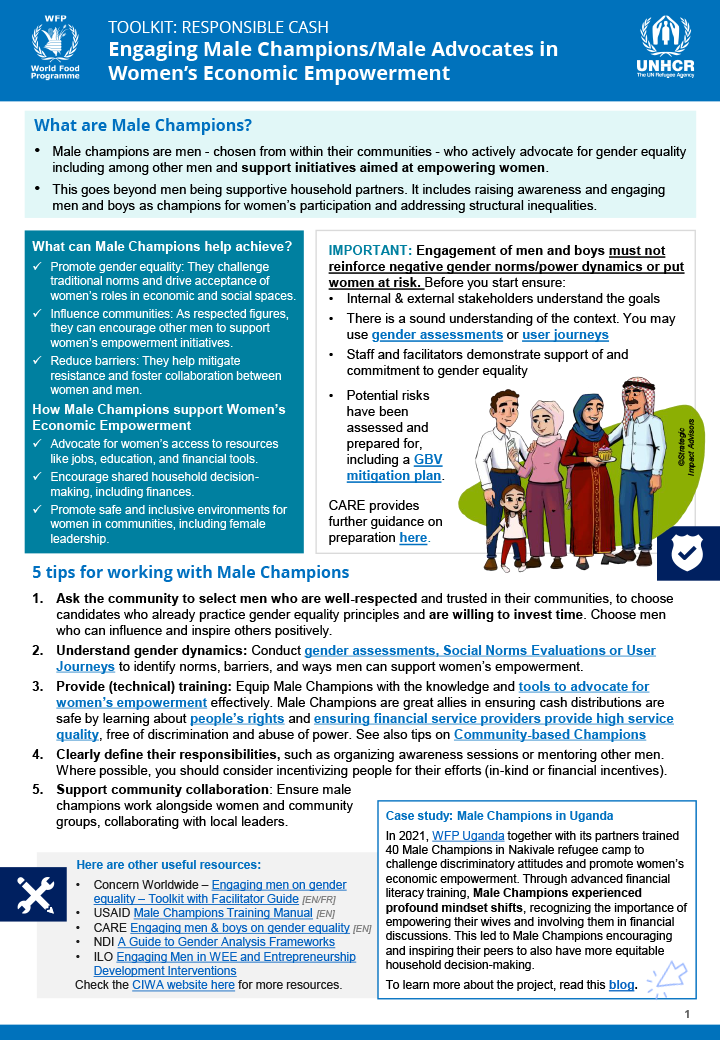

Engaging Male Champions/Male Advocates in Women’s Economic Empowerment

Engage male champions to drive gender equality and empower women’s economic participation. Male Champions are respected men from within their communities who actively advocate for gender equality and women’s economic empowerment with their peers. They challenge norms, influence their community, and reduce barriers by promoting women’s access to resources, shared decision-making, and safe environments. This […]

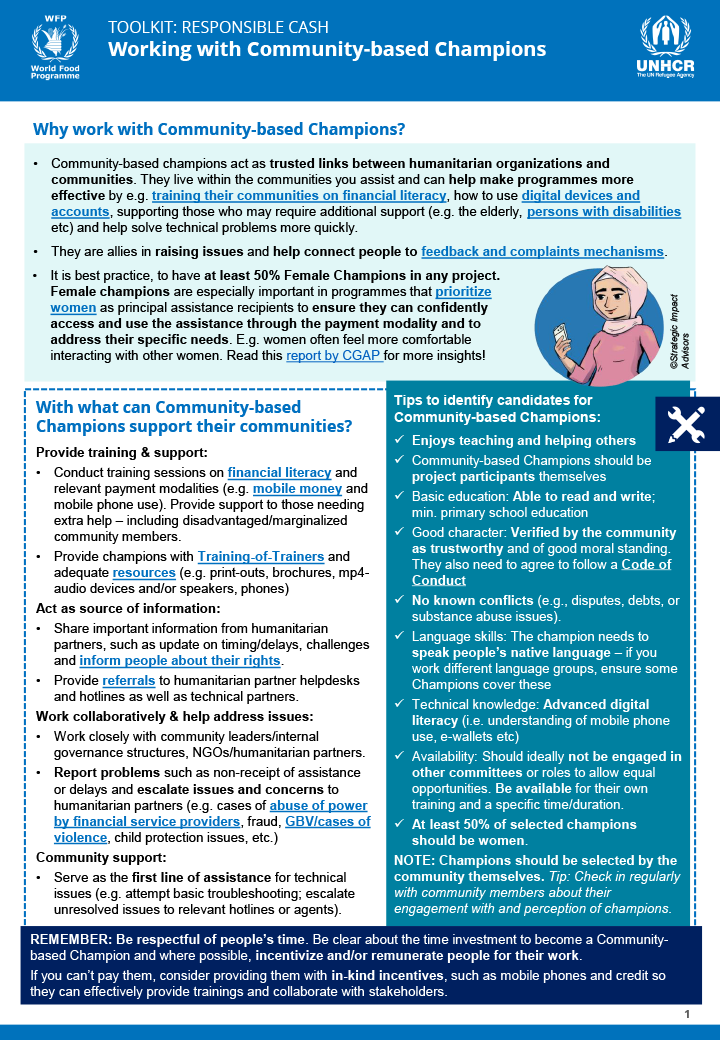

Working with Community-based Champions

Leverage trusted community members to enhance humanitarian/development programme effectiveness. Community-based champions act as trusted links between humanitarian organizations and communities. They live within the communities you assist and can help make programmes more effective by e.g. training their communities on financial literacy, how to use digital devices and accounts, supporting those who may require additional […]

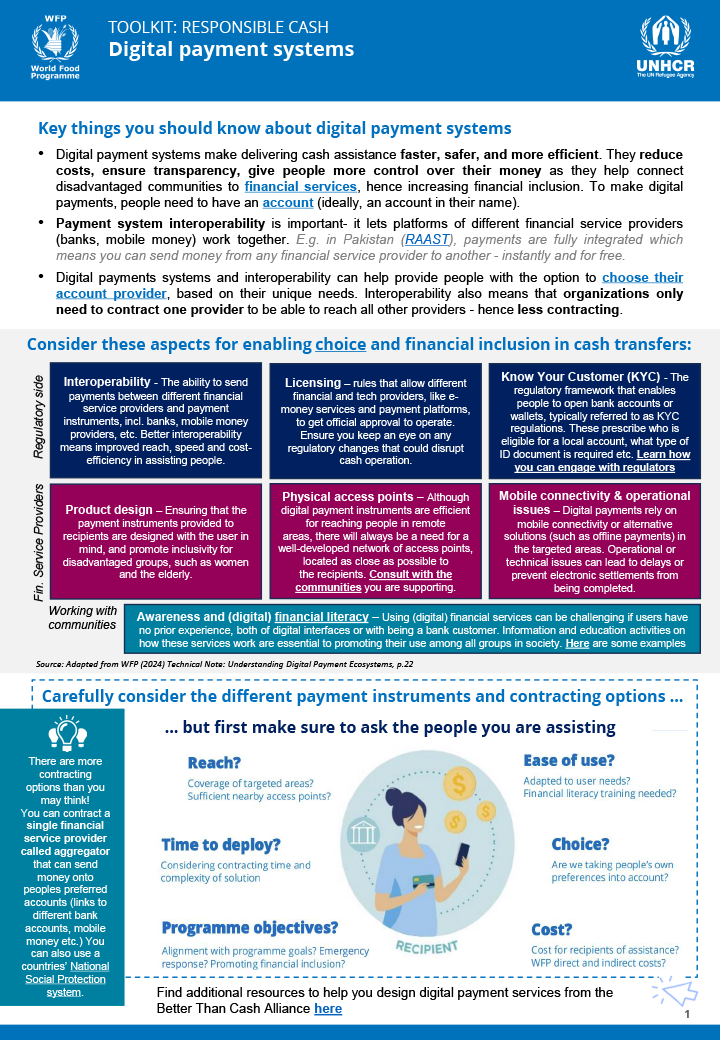

Digital payment systems

Understand how digital payment systems work, including how to select different payment instruments and contracting options. Digital payment systems make cash assistance faster, safer, and more transparent while promoting financial inclusion. They enable choice through interoperability, reduce costs, and connect people to formal financial services. This tool helps you understand how digital payment systems work […]

Strengthening digital financial inclusion through G2P payments and Social Protection

How can you use G2P payments to deliver assistance efficiently and sustainably. Government-to-Person (G2P) payments leverage national social protection systems – the world’s largest safety nets – to deliver assistance efficiently and at scale. This tool explains the benefits of G2P systems and outlines the steps to help build sustainable local solutions through using G2P […]

Measuring progress for digital and financial inclusion

Measure progress and demonstrate results to tell how digital financial inclusion activities have make a difference in people’s lives. Measuring progress on digital and financial inclusion is essential to understand impact and improve programmes. This tool explains the importance of measuring progress to inform better programmes and provides staff and partners with quantitative example metrics […]