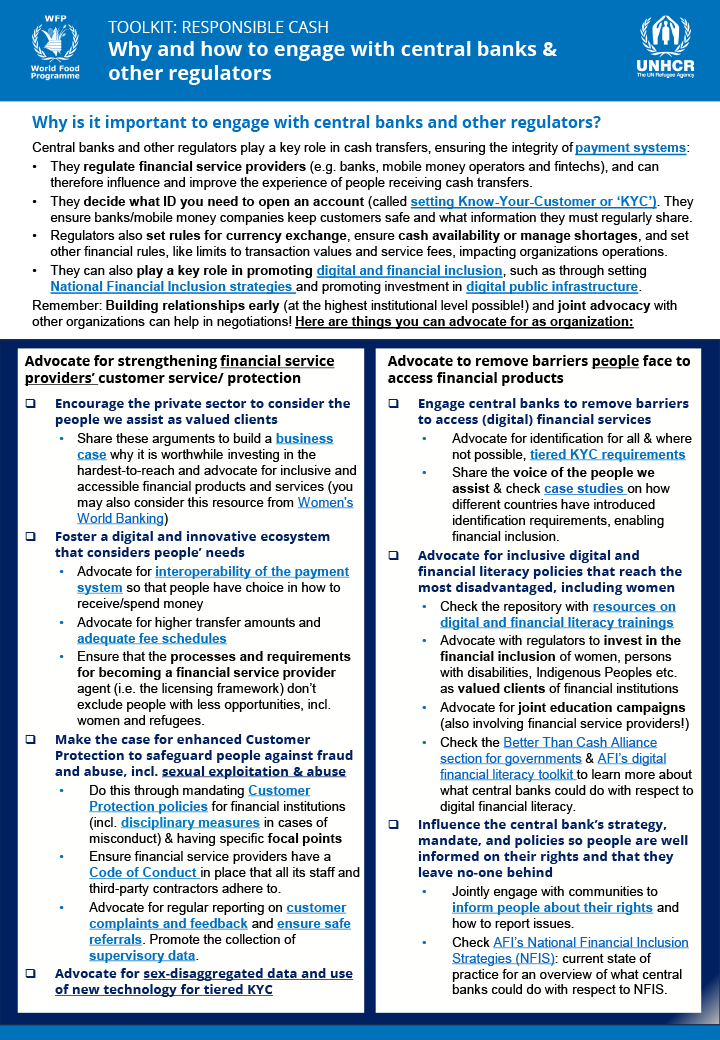

Equipping organizations to engage with central banks and other regulators for more accessible and inclusive financial systems

Central banks and other regulators play a key role in cash transfers, ensuring the integrity of payment systems.

This tool explains why and how to engage with central banks and regulators to strengthen cash transfers. It outlines their role in setting Know-You-Customer (KYC) requirements, regulating financial service providers, and promoting financial inclusion. It also provides advocacy tips to remove access barriers, improve customer protection, and foster inclusive digital ecosystems for the most disadvantaged.