Advocate with government & regulators

© Anna Zylicz

Advocating for inclusive national regulatory environments

Advocate and partner with central banks and other regulators to make cash transfers inclusive, safe, and accessible

Central banks and regulators are critical to humanitarian cash transfers – they set account opening requirements and rules, oversee payment systems, and ensure providers operate fairly and securely. Engaging them early helps remove access barriers, protect disadvantaged and marginalized groups, and build inclusive digital ecosystems, making humanitarian payments safer, faster, and more equitable.

This section provides humanitarian/development teams with tools and resources to advocate with central banks and other regulatory authorities, ensuring people, including the most disadvantaged, can meaningfully benefit from cash transfers.

Tools and Resources

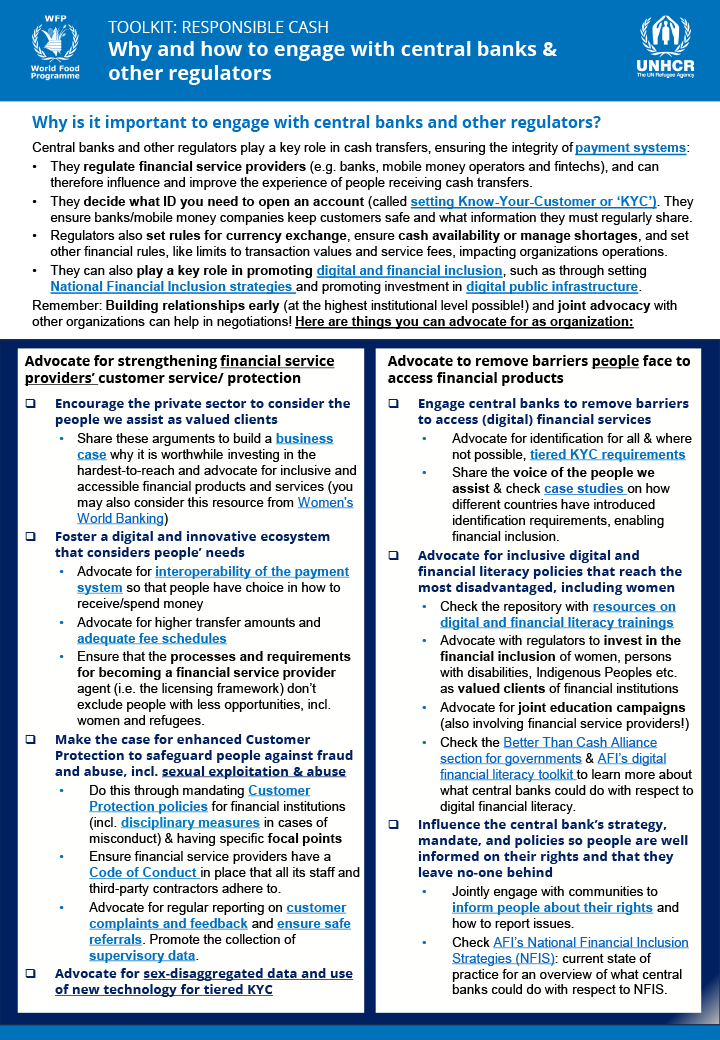

Why and how to engage with central banks & other regulators

Equipping organizations to engage with central banks and other regulators for more accessible and inclusive financial systems Central banks and other regulators play a key role in cash transfers, ensuring the integrity of payment systems. This tool explains why and how to engage with central banks and regulators to strengthen cash transfers. It outlines their […]

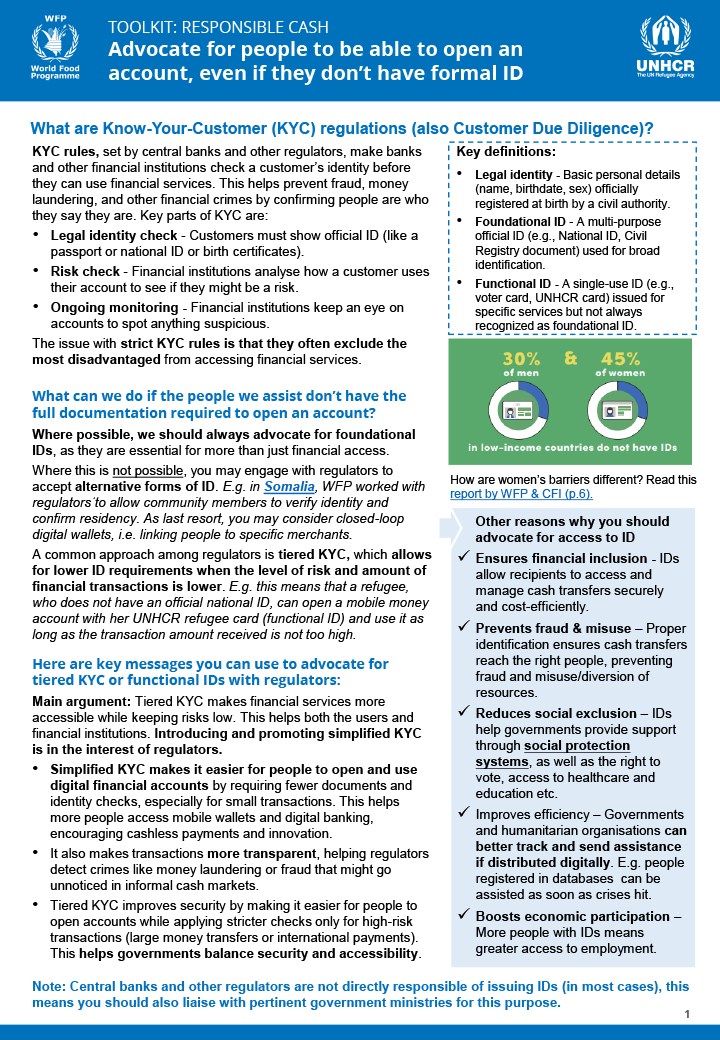

Advocate for people to be able to open an account, even if they don’t have formal ID

Advocate with central banks and other regulators to help people open accounts Access to Identification document (ID) is key to financial inclusion, security, and social participation. This tool is designed to help you advocate for people’s right to open a bank account – even without formal ID. It helps explain to government stakeholders why IDs […]

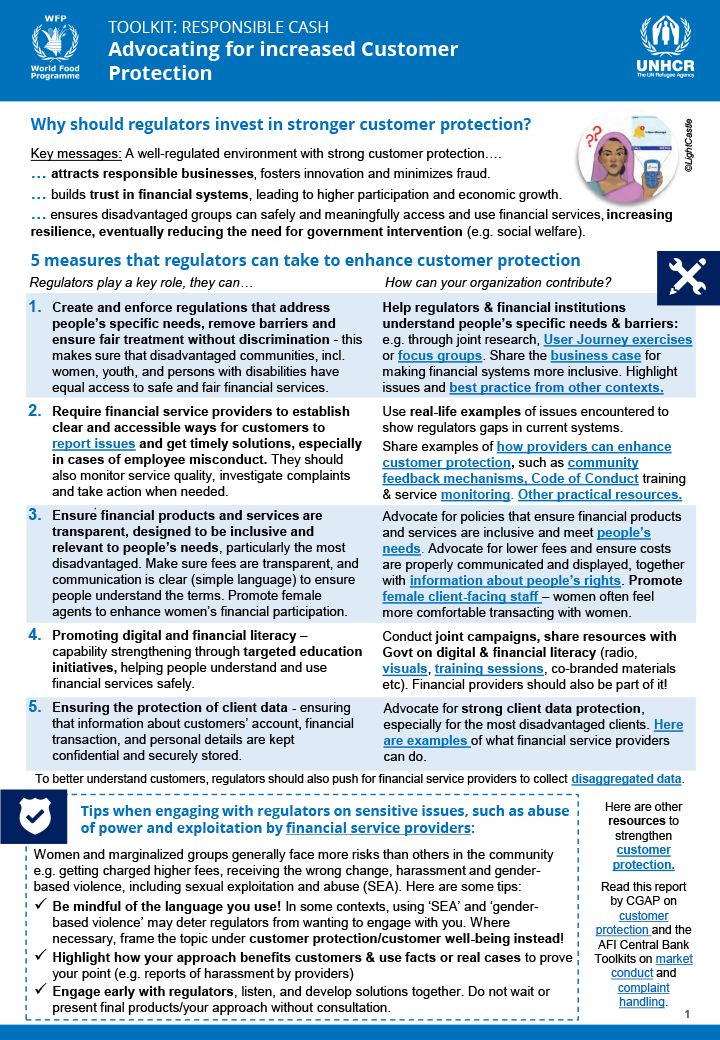

Advocating for increased Customer Protection

Advocate with central banks and other regulators to improve customer protection. A key role of central banks and regulators is to ensure fair, transparent, and inclusive financial services by setting and enforcing rules, monitoring providers, protecting data, and promoting customers. This tool equips you to engage with central banks and other regulators on improving customer […]

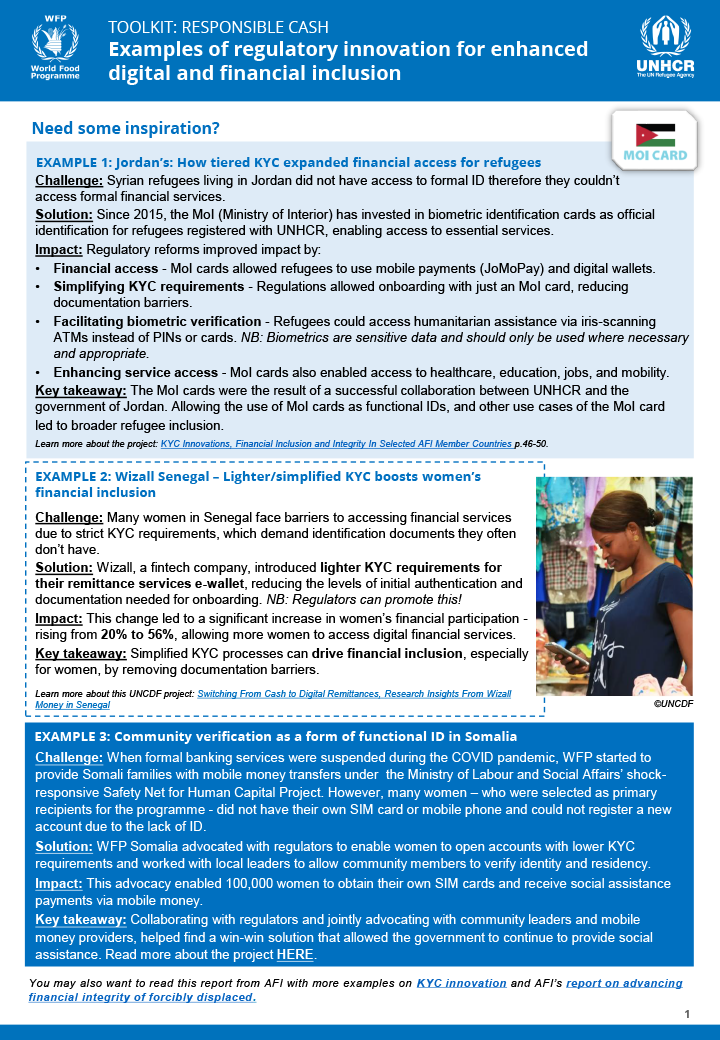

Examples of regulatory innovation for enhanced digital and financial inclusion

Use these global examples for your advocacy efforts to inspire people-centered, inclusive financial regulation. Explore this collection of six different country examples showcasing regulatory innovation for enhanced digital and financial inclusion (incl. simplified account opening, enhanced customer protection and investments in digital public infrastructure and more people-centered national financial systems). You may find these examples […]