Designing digital and financial literacy trainings

© WFP/Gabrielle Menezes

Financial education leads to higher levels of financial literacy that may enhance financial wellbeing in the long term.

This section introduces digital and financial inclusion and contains useful guidance and resources explaining why it is important, and how to design successful digital and financial inclusion training.

Tools and Resources

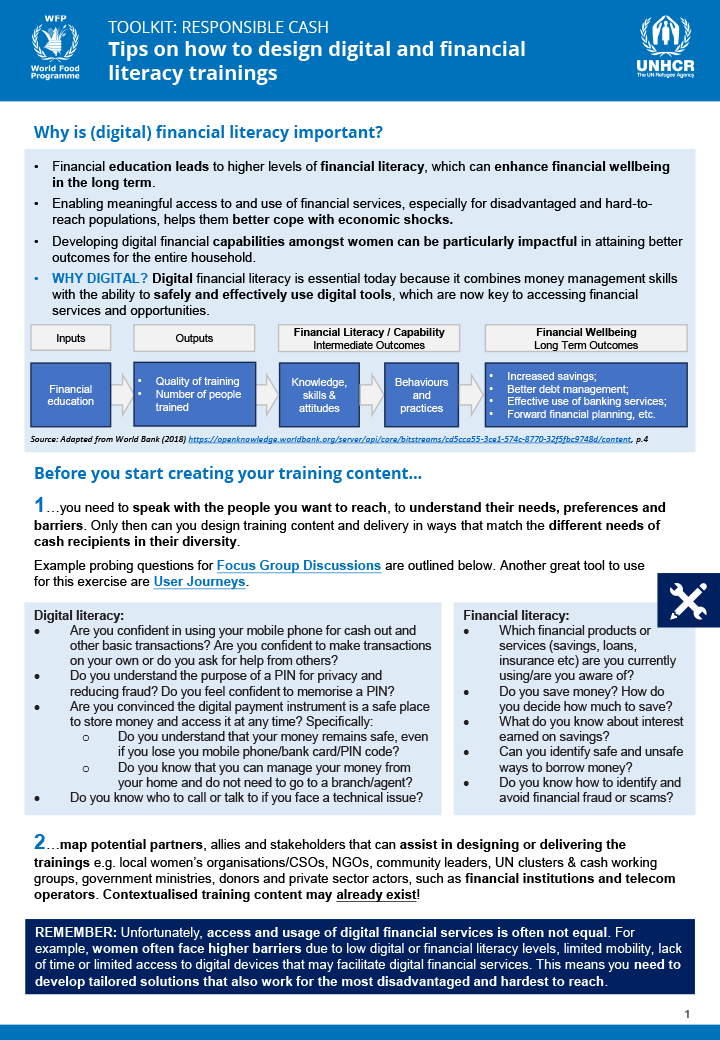

Tips on how to design digital and financial literacy trainings

Design digital and financial literacy trainings to empower people to use financial services safely and confidently. Digital and financial literacy is not only about using a device – it is about building confidence, safeguarding dignity, and strengthening people’s independence. This section introduces digital and financial literacy and contains practical, ready-to-use tools and examples to help […]

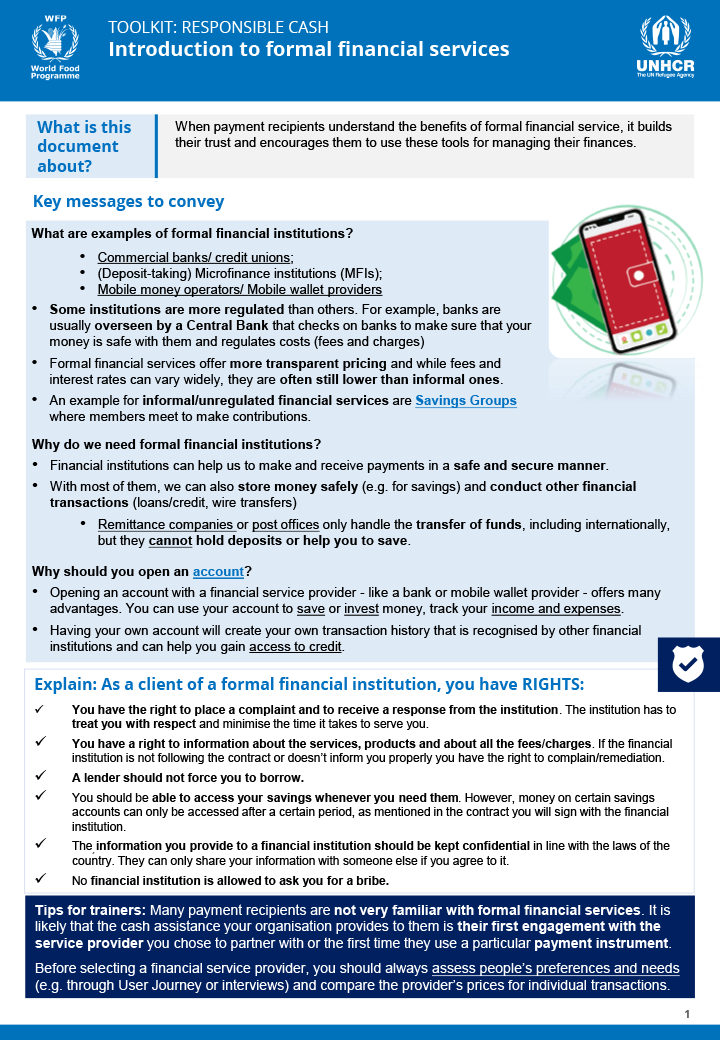

Introduction to formal financial services

Practical guidance to help people understand the benefits of formal financial services Formal financial services provided by regulated institutions like banks, mobile money providers, or microfinance institutions – offer safe, reliable ways for people to save, receive cash transfers, make payments, and build financial resilience against shocks. This tool breaks down the basics in clear, […]

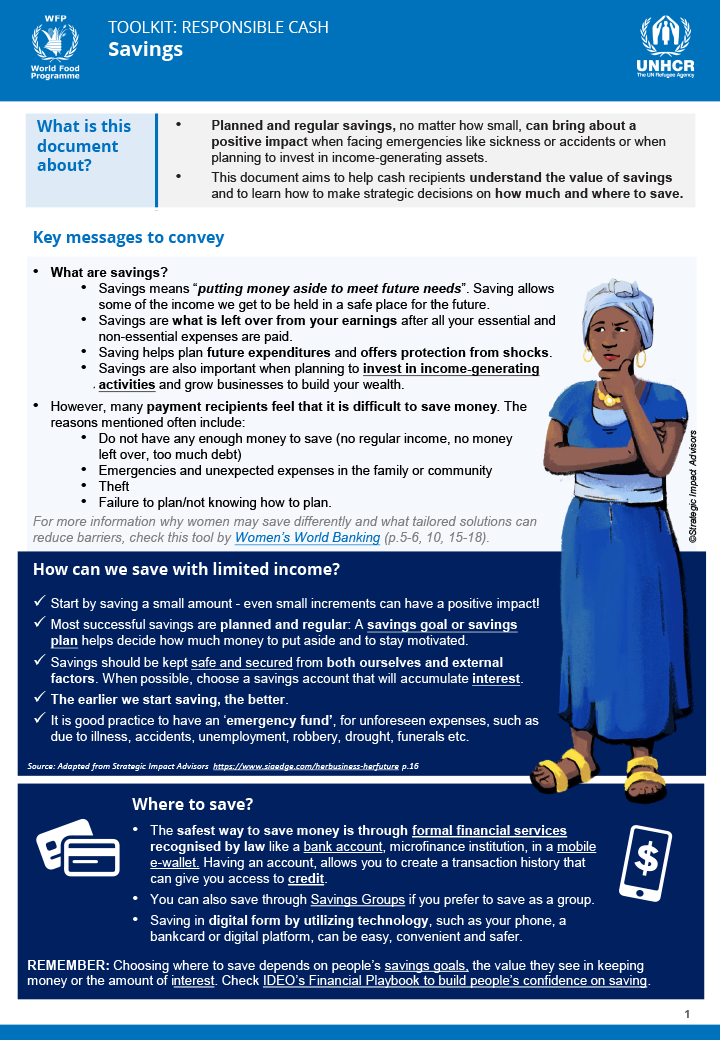

Savings

Key messages to help people understand the value of saving and develop simple, realistic savings habits – even with limited income. Saving – even small amounts – can strengthen financial security, support long-term goals, and help households cope with unexpected costs. This tool explains what savings are, why they matter, and how to make a […]

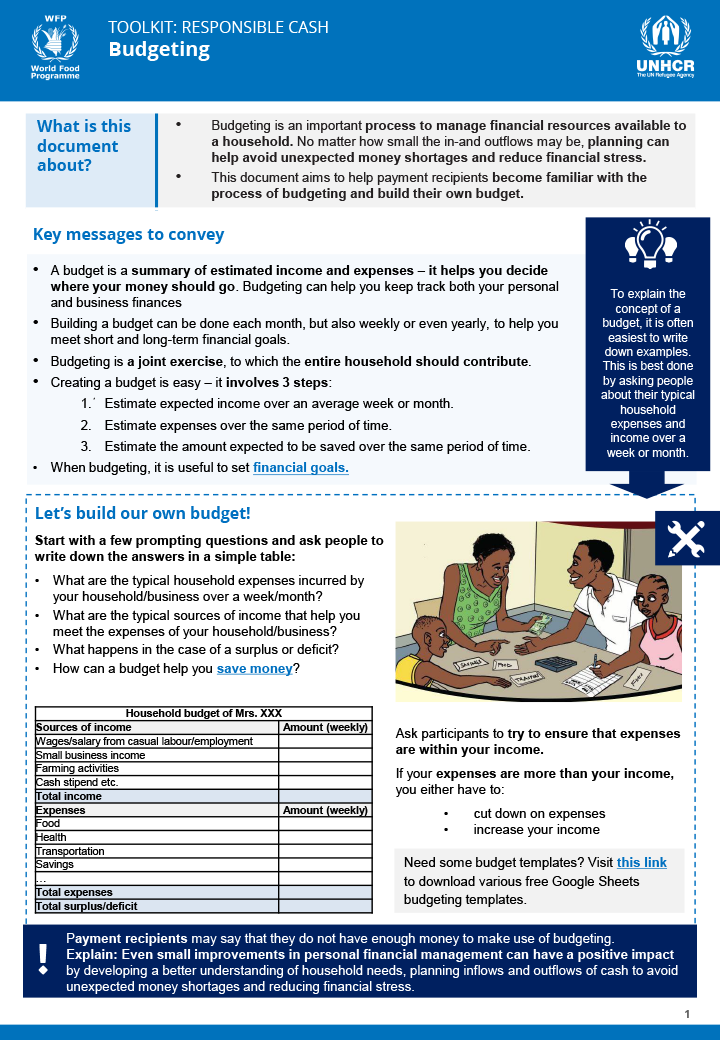

Budgeting

Simple, practical guidance to help people plan their income and expenses, avoid financial stress, and make decisions about how to use their money. Budgeting is the process of estimating income and expenses over a time-period. It helps households to see where money incomes from, where it needs to go, and how to avoid unexpected shortages. […]

Credit and debt management

Practical guidance to help people understand credit, borrow responsibly, and avoid over-indebtedness. This tool helps you explain what credit and debt are, how loans work, and the importance of understanding key terms like interest, collateral, and repayment schedules. It helps people make informed decisions before borrowing, recognize safe credit options, and plan repayments responsibly. Participants […]